Resources

Content Type:

Industry:

Service:

Topic:

2024 Internal audit outlook: Navigating digital disruption

In this insightful session, we will explore how agility is paramount for internal audit to dynamically respond to changing business conditions and ensure alignment with organizational objectives.

Navigating the transition of your business: Why the time is now

RSM US LLP's webcast will explore the importance of planning early for your business transition with best practices and real scenarios

Navigating the complex landscape of artificial intelligence adoption

Artificial intelligence (AI) has rapidly become a key element of business strategies. But what are the risks companies need to consider?

Retirement plan audit and contribution considerations

The evolving retirement plan landscape opens opportunities for companies to review employee compensation packages and consider changes to their plans.

Bad debt tax deduction method proposed for financial institutions

Banks and insurance companies would see a simplification of their tax reporting of credit losses under proposed regulations.

Tax reporting and withholding: Planning for the year ahead

Learn about changes in U.S. tax reporting and withholding requirements and what you can do now to plan for upcoming 2024 deadlines.

The workers and workplaces of the future

How companies are adapting hiring practices and workforce strategies, given the shrinking U.S. labor force, according to the U.S. Chamber of Commerce.

Compensation and benefits planning can help you navigate an aging workforce

Considerations for structuring compensation and benefit plans that help companies minimize the costs and risks of retiring workers.

6 signs your organization’s finance function needs modernizing

The finance function has grown increasingly complicated, and in today's uncertain and competitive environment, your organization can't afford to fall behind.

Modernizing your internal audit with artificial intelligence

Join our team for Episode 3 of Material Observations: Insights on Internal Audit.

Year-end tax planning guide for individuals

RSM's 2023 year-end tax planning guide for individuals and business owners.

How companies can create and capture value from generative AI

With broad adoption of generative artificial intelligence, organizations can enhance not only how they create value but also their methods of capturing it.

IRS and Treasury release guidance on tax credit for home energy audits

IRS and Treasury release guidance on tax credits for home energy audit expenditures claimed under the energy efficient home improvement credit.

IRS releases guidance on Roth catch-up contributions under SECURE 2.0

Notice 2023-62 provides an administrative transition period for Roth catch-up contributions to high-income individuals.

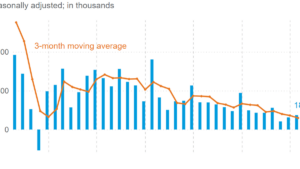

U.S. August jobs report: Labor market continues to cool

In August, the U.S. economy added 187,000 jobs and the unemployment rate settled in at 3.8%, according to Labor Department data released on Friday.

No results found.